Changes Around the Turn of the Century

The end of the 20th Century saw the advent of minimalism and grunge, where shopping for fashion was viewed as politically incorrect. At the same time, it was a period of no limitations and turmoil between globalization, the War in Kuwait, unemployment, AIDS, and the constant provision of media-created “emotion” which went hand-in-hand with celebrity stalking. This emotional overload and negative view of overt consumption led to an increased interest in the eco-look and the spread of street fashion and athletic wear (including the Puma/Jil Sander and Adidas/Yamamoto collaborations). The market froze after 9-11, coming back with a sense of controlled vivacity, where people felt a renewed interest in self-expression. The trend of mix-and-match also emerged, allowing people to make their own way, far from the rules of the 80s Total Look.

The end of the 20th Century saw the advent of minimalism and grunge, where shopping for fashion was viewed as politically incorrect. At the same time, it was a period of no limitations and turmoil between globalization, the War in Kuwait, unemployment, AIDS, and the constant provision of media-created “emotion” which went hand-in-hand with celebrity stalking. This emotional overload and negative view of overt consumption led to an increased interest in the eco-look and the spread of street fashion and athletic wear (including the Puma/Jil Sander and Adidas/Yamamoto collaborations). The market froze after 9-11, coming back with a sense of controlled vivacity, where people felt a renewed interest in self-expression. The trend of mix-and-match also emerged, allowing people to make their own way, far from the rules of the 80s Total Look.

Rampant consumerism came back, and most brands responded by producing products in lower price ranges to attract aspirational clientele seeking to buy into a luxury lifestyle. The proliferation of retail outlets from first-tier cities through third tier cities, together with mass media and global web communications ensured that people all around the world could access fashion and luxury. While an excessive consumption trend helped contribute to the credit crisis, it also helped to fuel the argument for conscientious spending, Corporate Social Responsibility (CSR) and ethical fashion.

Today, advances in technology for textile development are increasing exponentially through intelligent materials, with no signs of stopping (including micro, thermo-regulator, anti-stress and perfumed fibers, bio-protective fabrics, etc). The men’s fashion segment also continues to grow into the multi-category system paralleled with womenswear.

Today, advances in technology for textile development are increasing exponentially through intelligent materials, with no signs of stopping (including micro, thermo-regulator, anti-stress and perfumed fibers, bio-protective fabrics, etc). The men’s fashion segment also continues to grow into the multi-category system paralleled with womenswear.

Among these market changes, the Italian system continues to evolve.

The Present & Future of Italian Fashion

What is “Made in Italy”?

Today, most of the remaining original Italian designers are reaching retirement, if they haven’t already. The whole of Europe is losing factory jobs in textiles and clothing as firms de-localize and imports increase, although Italy has seen this trend occur more slowly than others.

However, with ever-diminishing production occurring within Italy, and with the country’s most prominent design houses being handed over to the leadership of international talents or private investment firms (the latest is Safilo), it is difficult to say what “Made in Italy” means today. There is currently an ongoing dispute in Europe as to the relevance of “Made in” labels. Northern European countries have already lost the majority of their factories to delocalization, and do not want the “Made in” label, as their goods are imported.

Within the Southern European countries, where the remaining manufacturers are typically located, lobbyists push to maintain the “Made in” labels on garments. However, even in Italy, manufacturers are producing parts in China and law only requires that a portion of the product be made within Italy to be considered “Made in Italy.” In fact, there was great controversy last year when an exposé on shady production processes aired at dinner time in Italy. The news piece showed Chinese immigrants working in sweatshop conditions as leathersmiths for designer brands, though within the borders of Italy (Prato and Florence). This system was initiated so brands could maintain their localized production, though with arguably less-skillful workers. Some Italian manufacturers viewed this move as a way to keep a closer eye on the outsourced production, using the cheaper labor force while maintaining local facilities. (You can read an English write-up on the case here.)

Within the Southern European countries, where the remaining manufacturers are typically located, lobbyists push to maintain the “Made in” labels on garments. However, even in Italy, manufacturers are producing parts in China and law only requires that a portion of the product be made within Italy to be considered “Made in Italy.” In fact, there was great controversy last year when an exposé on shady production processes aired at dinner time in Italy. The news piece showed Chinese immigrants working in sweatshop conditions as leathersmiths for designer brands, though within the borders of Italy (Prato and Florence). This system was initiated so brands could maintain their localized production, though with arguably less-skillful workers. Some Italian manufacturers viewed this move as a way to keep a closer eye on the outsourced production, using the cheaper labor force while maintaining local facilities. (You can read an English write-up on the case here.)

A Dying Breed

Also suffering are the Italian production districts, evolved from generations of craftsmen with tacit knowledge of leather goods and textiles. These districts naturally developed into their own textile and leather goods pipelines, with separate small factories or workshops supporting one another through their own particular specialties. They created very attractive production communities, where brands and larger manufacturing companies could source work. Young Italians no longer want to follow their parents into production or craft-related vocations, and so the Chinese are coming to provide the labor necessary to get the job done. Meanwhile, the production pipeline of these districts is breaking down because the cost is forcing the bigger manufacturers and their brands to send work to Asia or Turkey… or it is being internalized with high-tech machinery and operators.

Also suffering are the Italian production districts, evolved from generations of craftsmen with tacit knowledge of leather goods and textiles. These districts naturally developed into their own textile and leather goods pipelines, with separate small factories or workshops supporting one another through their own particular specialties. They created very attractive production communities, where brands and larger manufacturing companies could source work. Young Italians no longer want to follow their parents into production or craft-related vocations, and so the Chinese are coming to provide the labor necessary to get the job done. Meanwhile, the production pipeline of these districts is breaking down because the cost is forcing the bigger manufacturers and their brands to send work to Asia or Turkey… or it is being internalized with high-tech machinery and operators.

Today’s Italian production companies have grown smaller as imports increase, and knock-offs are a major force in destroying manufacturing innovation. However, even as their numbers dwindle, it was the Italian fabric weavers and leather workers who manufactured the most creative works, making Italy a key player in the international fashion scene.

Today’s Italian production companies have grown smaller as imports increase, and knock-offs are a major force in destroying manufacturing innovation. However, even as their numbers dwindle, it was the Italian fabric weavers and leather workers who manufactured the most creative works, making Italy a key player in the international fashion scene.

In addition to the production side, on the creative end we’ve seen prominent Italian designers retiring. While other fashion capitols have a history of nourishing and promoting their young designers, in Italy, you typically must already have a name in place in order to be successful. Very few new designers have climbed the the ranks of Italian fashion since the late 80s. This adds pressure to the “Founder’s Dilemma,” which poses a challenge when a brand is built around a specific personality, and that personality is no longer involved with the brand. In the last year alone, two prominent Italian designs, Gianfranco Ferré and Valentino, left the fashion world and were skeptically replaced by young designers with mixed results.

Focus on Retail

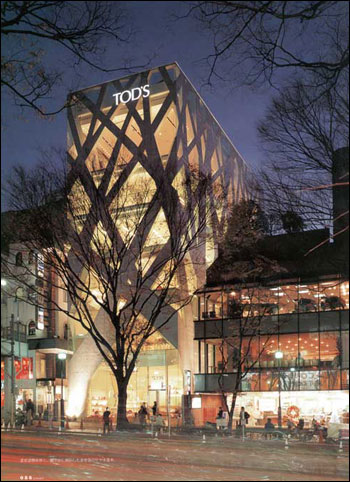

Fashion companies have moved their focus downstream into retail, where experience shopping became the new communication tool. Italian brands have excelled in this retail model, rolling out branded temples to shopping in both developed and emerging markets. This had been a great model for generating revenue until the beginning of the financial crisis, which forced many retailers to close their doors, pack up and go home. In addition to creating more demand than most Italian manufacturers were able to economically provide, it also had the controversial effect of spreading luxury goods across such a vast environment that many began to ask if an item that could be found anywhere could still be considered luxury.

Fashion companies have moved their focus downstream into retail, where experience shopping became the new communication tool. Italian brands have excelled in this retail model, rolling out branded temples to shopping in both developed and emerging markets. This had been a great model for generating revenue until the beginning of the financial crisis, which forced many retailers to close their doors, pack up and go home. In addition to creating more demand than most Italian manufacturers were able to economically provide, it also had the controversial effect of spreading luxury goods across such a vast environment that many began to ask if an item that could be found anywhere could still be considered luxury.

Question: if it’s no longer Made in Italy, and it’s available everywhere, does it still fit within the Italian model? Can it be considered luxury?

Digitally Challenged

In spite of having a historic foundation of market-savvy entrepreneurs who enabled Italian fashion to flourish, Italian companies have been among the slowest to evolve their business model in support of the digital age we will live in from this point on. YOOX has been working diligently over the last 2 years to expand their e-commerce services from fewer than 5 Italian brands to more than 20 by the year’s end. However, with such rapid growth of the company’s client group, complaints about disorganization and customer service, quality control issues and a general lack of bleeding-edge technology and brand imaging must be dealt with, in order to preserve the luxury status so carefully simulated in the physical retail environment.

A New Foundation

With the current state of the economy, many brands are struggling. Budgets are being pulled from fashion week and marketing to make ends meet. However, as new designers refuse to become celebrity circuses, and supermodels are an extinct breed, the system needs an infusion of excitement to revitalize the industry.

In the place of generations of craftsmen, a new group of technologically skilled, creative young people have emerged. Universities in Italy have provided a focus in research and development in new textiles and industrial techniques, as well as fashion design, e-commerce, brand management and marketing. The way I see it, Italian companies still have a chance at maintaining their Italian-brand viability if they focus on some key success factors which they maintain.

The following are my ideas of some key resources in Italian fashion and luxury, and how to utilize them:

- Italian heritage and family ownership of the majority of brands: market the origins of the brand and focus on the highest craftsmanship within the labels, and reign in investment in cheap production that dilutes the brand image (focus on the top of the brand pyramid, not the mass-market base). Nothing is worth damage to the brand.

- The last remnants of skilled Italian craftsmen, who have tacit knowledge passed down through the generations in addition to more recently acquired technical skills: groups like Altagamma would serve the industry well to promote these people, as they have a lot to offer in terms of passing down a great legacy. Since time is running out on this resource, it seems prudent to put some marketing muscle behind these artists, promoting their irreplaceable skills as something honorable and special, not “country” and uneducated.

- Students trained in textiles R&D and business innovation: there is an increasing market for ethical fashion, and Corporate Social Responsibility (CSR) will continue to grow as a concern for fashion and luxury consumers. These young graduates can help move the Italian industry forward to implement new techniques that are environmentally friendly and ethically sound. Italy can be a leader in this realm based on a heritage of innovation, the existing manufacturing infrastructure and the skills of its labor pool.

- A large labor pool of digitally-savvy, internationally minded young people who grew up in a branded environment: as the Luxury Society just reported, it’s time that the patriarchs of the European fashion and luxury sector took a moment to listen to their grandchildren. The necessary knowledge and capabilities required to move the Made in Italy industry into the future is ready and waiting (and currently underemployed).

Main point: The commitment to heritage in production is what boosted the Italian brands in the world’s eye. The reluctance of some of the most prominent brands to continue advancing with an evolving market may be the downfall of the Italian industry.

Here’s what I want out of a luxury brand: I want the feel of the brand. I want the background story behind the items I love- how it was conceived, how it was constructed; what makes it special. I want to know what music the design team is listening to, and I want to be able to download playlists from fashion week and songs that are related to the collection, whether from inspiration or just setting the mood. If, like in

Here’s what I want out of a luxury brand: I want the feel of the brand. I want the background story behind the items I love- how it was conceived, how it was constructed; what makes it special. I want to know what music the design team is listening to, and I want to be able to download playlists from fashion week and songs that are related to the collection, whether from inspiration or just setting the mood. If, like in